In the dynamic world of forex trading, keeping up with the latest news and trends is crucial for success. Forex traders rely on real-time information to make informed decisions that can significantly impact their portfolios. As the foreign exchange market operates 24 hours a day, the flow of information is constant, making it essential to stay alert to news from around the globe. Whether you are a seasoned trader or just starting out, understanding the implications of economic events, geopolitical developments, and market sentiment is vital. This article will equip you with the knowledge you need to navigate the ever-changing landscape of forex trading news. For those interested in regional specifics, you can check out forex trading news Forex Brokers in Saudi Arabia, where localized trends can greatly affect trading strategies.

The Importance of Economic Indicators

Economic indicators are statistical data points that traders analyze to gauge the economic performance of a country. Some of the most critical indicators include Gross Domestic Product (GDP), unemployment rates, inflation rates, and consumer confidence indexes. These metrics provide insight into a nation’s economic health, influencing currency value fluctuations. For instance, a higher-than-expected GDP growth can lead to currency appreciation, whereas a spike in unemployment might weaken the currency. Thus, staying updated on the release schedules of these indicators is key. Following economic calendars can help traders anticipate market movements driven by these announcements.

Geopolitical Events and Their Impact

Geopolitical events can also have profound effects on the forex market. Political instability, elections, trade negotiations, and international conflicts often create volatility that traders can capitalize on. For instance, when tensions rise in a particular region, safe-haven currencies like the US dollar or Swiss franc typically strengthen as investors seek to minimize risk. Conversely, currencies from countries embroiled in turmoil may weaken. Therefore, having an awareness of the geopolitical landscape and its potential repercussions on currency pairs can provide traders with valuable trading opportunities.

Central Bank Policies and Their Significance

Central banks play a pivotal role in shaping the forex market. Decisions regarding interest rates, quantitative easing, and monetary policy directly affect currency valuations. A central bank’s announcement about changing rates can lead to immediate market reactions, influencing trader sentiments and positions. For example, if the Federal Reserve hints at a rate hike, the US dollar may rise in anticipation. Traders need to pay attention to central bank meetings and statements to gauge future monetary policy directions, allowing them to position themselves advantageously.

Market Sentiment: Understanding Trader Psychology

Market sentiment reflects the overall attitude of traders towards a particular currency or market. It can be influenced by various factors, including economic data releases, political events, and financial news. An optimistic sentiment among traders can lead to bullish trends, while pessimism can trigger bearish movements. Tools such as sentiment indicators can help traders assess current market moods, enabling them to enter or exit trades with more confidence. Monitoring social media, news outlets, and trading forums can offer valuable clues about market sentiment dynamics.

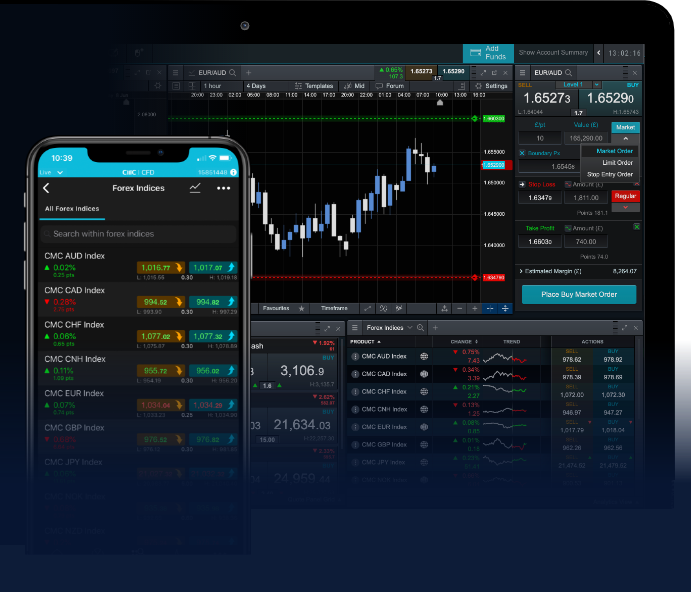

Technological Advances in Forex Trading

Technology has reshaped the forex trading landscape, making it more accessible and efficient. Online trading platforms provide traders with a wealth of information, tools, and resources to aid in their decision-making. Algorithms and automated trading systems have become popular among traders, allowing for the execution of trades based on predetermined criteria. Furthermore, mobile trading apps enable traders to stay connected and execute trades on the go. Embracing these technological advancements can enhance a trader’s experience and provide them with a competitive edge.

Educating Yourself: Continuous Learning is Key

The forex market is ever-evolving, and continuous education is essential for success. Traders should regularly seek out trading courses, webinars, and articles to expand their knowledge and stay updated on market trends. Engaging with experienced traders and joining trading communities can also facilitate learning. Additionally, reflecting on your trading experiences, whether successes or failures, can help you refine your strategies and improve your skill set over time.

Final Thoughts

In conclusion, staying updated with forex trading news is imperative for any trader looking to thrive in this competitive market. By understanding economic indicators, geopolitical events, central bank policies, market sentiment, and technological tools, traders can make informed decisions that align with their trading strategies. Furthermore, the importance of continuous learning cannot be overstated; the more knowledge you acquire, the better equipped you’ll be to navigate the challenges of forex trading. Remember that each piece of news can bring opportunities as well as risks, so maintaining a balanced approach is crucial for long-term success in the forex arena.